Remember to mention home upgrades to your insurance agent.

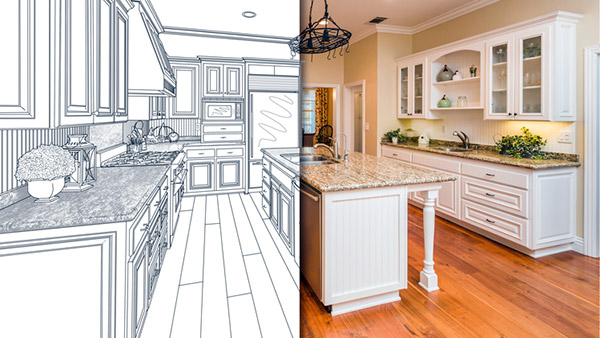

Remodeling and renovation projects can add significantly to the value of your home. Whether you do it yourself or hire a contractor, remember to update your homeowner insurance as you increase your home’s value.

The Coverage A limit on your homeowner policy is the amount of insurance you have to reconstruct your home in the event of a total loss. All costs associated with replacing or rebuilding your home are considered when developing this Coverage A limit. When you make changes that increase the value of your home, you may also need to increase the coverage limit.

Reconstruction cost is the cost to hire a contractor to replace the home as it is, in today’s marketplace, using materials and design of similar quality. Determining the reconstruction cost of your home can be a challenging and complex process. In most situations, reconstruction cost does not reflect the market value, tax assessor value or the initial construction cost of the home – even on a new home.

As you plan your next project, take an inventory of your home’s new features. Consider interior changes as well as exterior.

- Does the addition on your home have a different roof material than the rest of your home?

- Does the new deck you built include a kitchen, built-in grill or electric fireplace?

- Is your contractor installing built-in bookshelves and TV cabinets?

- Are you finishing your attic area to create an extra bedroom?

- Did you upgrade your windows?

You may put lots of time into picking out countertops and appliances for your new basement kitchen, type of wood for cabinetry, color of brick to match the original portion of your home, quality of decking materials and other factors. Remember to share these important changes with your insurance agent.

Most insurance companies offer a replacement cost endorsement to ensure you will get the full reconstruction cost to rebuild your home in the event of a covered total loss, or a percentage more than the limit of insurance on your declarations page. You may also wish to explore this option with your agent.

Discuss your homeowner coverage with your independent agent to be sure your home and the investment it represents are adequately insured in the event of a loss.

More information:

Don’t be surprised by the cost to rebuild your home

7 factors to help nail down your home’s reconstruction cost

Coverages described here are in the most general terms and are subject to actual policy conditions and exclusions. For actual coverage wording, conditions and exclusions, refer to the policy or contact your independent agent.