Not all automobile insurance policies are the same. When you’re shopping for auto insurance, ask your agent questions about coverage BEFORE you buy. You will have peace of mind that your car and your passengers are protected, reducing the chance of unwanted surprises should you have a claim.

Here are some questions you might want to ask:

-

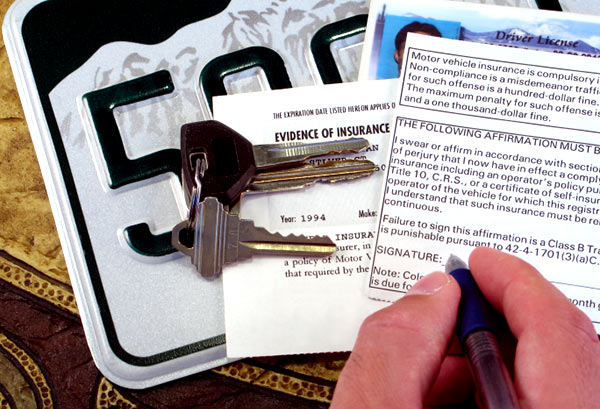

- My state requires me to show that I have a minimum amount of insurance whenever I renew my driver’s license. Am I covered? Your local, independent agent understands the minimum coverage requirements in your state and can assure that you meet those standards. However, you may want to consider that many state minimums are quite low and may not protect you from the financial consequences of a serious accident. If you have an auto loan, your lender may require additional coverage on the car. Ask your agent to advise you about an appropriate amount of insurance for your situation.

- I recently bought a brand new car. I have heard that the car depreciates as soon as you drive it home, and that in the event of a total loss, insurance may not pay the entire value. What can I do? Ask your agent about how your policy pays in the event of the total loss of a new vehicle. Some policies include coverage to protect you from the gap between the depreciated value and the cost of a new vehicle and provide replacement cost for qualifying vehicles. If your policy does not include this coverage, ask your agent if you can purchase gap coverage for an additional premium. (Read our related blog: How to keep that new car feeling alive.)

- What is uninsured and underinsured motorist coverage, and do I need it? Uninsured motorist coverage may pay for damages arising from bodily injury to a covered person when another driver is legally responsible for the auto accident and does not have liability coverage, or their liability limits fall below state minimum requirements. Underinsured motorist coverage may pay for damages when another driver is legally responsible for the accident but has liability limits lower than those on your policy. Ask your agent to advise you, about financial protection for these situations. Medical and repair costs have been increasing in recent years and could quickly exceed your financial resources. (Read our related blog: 7 coverages to look for in an auto policy.)

- How can I save money on my auto insurance premium? One option is to choose a higher deductible. The deductible is the amount of a loss that you are responsible to pay for yourself. If you can afford a higher deductible through savings or other resources, you can often save on premiums. Your agent can help you find the right balance.

Coverages described here are in the most general terms and are subject to actual policy conditions and exclusions. For actual coverage wording, conditions and exclusions, refer to the policy or contact your independent agent.