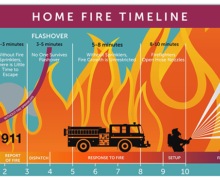

Sprinklers protect your home from biggest threat: Fire

One of the most significant threats to your home, its contents and those living there is a fire. If you’re building a new home or planning a major renovation of your existing home, consider installing or retrofitting with a fire sprinkler system. Sprinklers save lives.